James Wallin joined AllianceBernstein Fixed Income in 2005, prior to which he was at Morgan Stanley Investment Management. James graduated from the State University of New York at Stony Brook in 1980 and received a Juris Doctor degree from New York Law School in 1983. He is a member of the New York Bar and a Solicitor of the Supreme Court of England and Wales. Prior to working at Morgan Stanley, James had been senior counsel at Evergreen Asset Management Corp., and general counsel and chief administrative officer at Yamaichi Capital Management Inc. He also worked in the legal department of The Dreyfus Corporation, and with the law firm of Cole and Dietz (now Winston and Strawn). James had also worked at Alliance Capital on a previous occasion, between 1982 and 1986. He is a member of the steering committee for the Securities Industry and Financial Markets Association (SIFMA) Asset Management Group and a buy-side representative on the Depository Trust and Clearing Corporation (DTCC)-sponsored global senior oversight group that is focusing on over-the-counter (OTC) derivatives-related processing and infrastructure issues.

ABSTRACT

This paper addresses current issues in the over-the-counter (OTC) derivatives processing arena, with a focus on credit derivatives. It describes the approach that has been adopted by regulators and the industry to deal with the explosive growth of this market, along with the processing and infrastructure issues that have arisen in connection with this growth. It also describes the industry responses to input regarding these issues from regulators in the USA and the UK. In addition to describing the history of the market and the rapid growth it has experienced in recent years, particular focus is given to the steps taken by the major dealers in OTC derivatives, the Depository Trust and Clearing Corporation (DTCC) and vendors that support the market to address the processing backlog and to put in place a scalable infrastructure that will support this business going forward. In this context, the author attempts to present these issues from a buy-side perspective, both to illustrate the issues and solutions to a broad audience, and to encourage buy-side participants in this market, along with their service providers, to embrace fully the change that has taken place. Particular attention is paid to the development by DTCC of the DTCC Warehouse, the Deriv/SERV confirmation and maintenance platform for OTC derivative transactions, and emerging vendor solutions for OTC derivatives processing, along with suggestions as to how industry participants can utilise these services.

Keywords: credit default swap, over-the-counter (OTC) derivatives, credit derivatives (CDS) market, Depository Trust and Clearing Corporation (DTCC), Deriv/SERV, Federal Reserve, Federal Reserve Bank of New York (FRBNY), Bank of England, International Swaps and Derivatives Association Inc. (ISDA), novation, cash settlement, convergence, senior oversight group, steady state, Securities Industry and Financial Markets Association (SIFMA), Managed Funds Association (MFA), straight through processing (STP)

OVERVIEW

The credit derivatives (CDS) market1 has grown explosively over the last decade and has become an important - and integral - component of the worldwide financial structure. While the purpose of this paper is to acquaint readers with the infrastructure improvements made in the CDS market over the past several years, and to provide insight into how to leverage these improvements, in particular, and into the trade information warehouse developed by the Depository Trust and Clearing Corporation (DTCC), the Deriv/SERV service and emerging vendor solutions, it is also important for industry participants to have a full awareness of the events that prompted these improvements and the respective roles of the participants in this process. With this understanding, industry participants can better work towards establishing best practice and can gauge more effectively the importance of integrating these improvements into their processing, recordkeeping and reporting infrastructure.

THE CREDIT DERIVATIVES (CDS) MARKET

From its emergence in 1996 to the present day, the CDS market has grown exponentially, totalling US$20.2tn in outstanding contracts at the end of 2006. Projections suggest that the growth will continue and will reach US$33.1tn in outstanding contracts by 2008.

Many factors have contributed to the phenomenal growth of the CDS market. From an economic standpoint, these include:

- the ability to gain off-balance-sheet leverage;

- increased liquidity and ready access to credit exposure;

- increased price transparency versus cash instruments;

- enhanced price discovery; and

- access to index and tranche products that provide broad credit exposure.

While the operations and processing improvements implemented in the over-the- counter (OTC) derivatives market prior to 2005 were significant steps forward, the OTC derivatives infrastructure did not keep pace with the market's growth. This stems not only from the fact that participants in the OTC derivatives market expect transactions to be tailored to meet individual needs, but also from the fact that the phenomenal increases in volume experienced by the CDS and the OTC derivatives markets overall were unanticipated, and were not supported by a centralised and automated infrastructure.

In this environment, the ability of the dealers to process transactions lagged behind the increasing volume. By mid-2005, there were over 150,000 unconfirmed credit derivatives transactions.3 This alone illustrates the clear disconnect between the size and importance of the CDS market, on one hand, and the state of the confirmation, record-keeping and processing side of the business, on the other.

Comments made by Alan Greenspan, former chairman of the Federal Reserve Bank of New York (FRBNY), clearly - and perhaps painfully - brought to light the problems of the rapid growth of the CDS market. While Greenspan has consistently expressed his belief that credit derivatives have played a positive role in the global marketplace and economy, in May 2006, he stated that he was 'frankly shocked' by CDS market trading mechanics and characterised the trading environment as one in which 'traders often buy and sell these instruments, known as credit-default swaps, over the phone without confirming their trades and relying on scraps of paper to record the details'.4

Greenspan's observations offer an important context. In particular, he illuminates the reality that it is impossible to expect the economic goals of participants in the OTC derivatives market to be met without ensuring that an appropriate infrastructure is in place. Participants in this market are not holders of instruments that have an independent legal existence, which can be bought and sold with little overhead or difficulty in an established market structure. The OTC derivatives is based on individually negotiated, bilateral contracts that have to be properly recorded, accounted for and confirmed with the other party, or parties, at each step of the trading and maintenance process. In contrast to the infrastructure challenges that are faced by other segments of the financial markets, the OTC derivatives market is unique in that, until recently, there was no mechanism independent of the parties for recording the particulars of a transaction.

By mid-2005, the state of affairs referred to by Greenspan, focusing, in particular, on the CDS market, had already become clear to both the regulators and the industry. Fortunately, the joint industry and regulatory response has, since then, led to innovative and meaningful change. The changes we have seen, along with those that will be implemented later this year and in future, will continue to support the growth of credit derivatives as an asset class. These changes will also support and enhance the stability, and growth, of the OTC derivatives market in general.

INDUSTRY AND REGULATORY ACTIONS SINCE 2005

The OTC derivatives market is an unregulated market that is based upon privately negotiated, bilateral contracts, which are entered into by sophisticated parties. The CDS market is part of this market, and its structure evolved within the existing framework for interest rate swaps and other privately negotiated derivatives, which is based predominantly on documentation promulgated by the International Swaps and Derivatives Association Inc. (ISDA). The individual participants in the market and the transactions that take place between the participants are not subject to any specific regulatory regime on a day-to-day basis.

Given this background, the impetus for the regulators' interest in this market and the nexus for their involvement was the concern that a series of major corporate credit events, while unlikely, might pose substantial risks to financial markets if the CDS market infrastructure were not to reflect accurately the outstanding obligations and liabilities of the participants. The regulators felt that a major credit event, coupled with a breakdown in the CDS market infrastructure, would not only be disruptive to participants in that market - including major banks and insurers, who rely heavily on credit protection - but could have significant ripple effects in the broader economy.

The regulatory alarm first sounded in February 2005, when the UK Financial Services Authority (FSA) called for steps via which to tackle the level of outstanding incomplete confirmations for credit derivatives.5 In July 2005, the Counterparty Risk Management Policy Group (CPRMG)6 issued a report that also called for firms to address this backlog, and to develop electronic trade matching and confirmation generation systems.7 The CPRMG also raised concern regarding the issues arising from assignments of credit derivatives, calling, in particular, for the establishment of a mechanism that would ensure that the consent of all three parties to an assignment had been obtained and properly recorded at the time of the assignment. The definitive regulatory step was taken by the Federal Reserve Bank of New York (FRBNY) in September 2005, when it arranged a meeting in New York that was attended by 14 of the major dealers in credit derivatives (the 'major dealers') and 14 financial services regulators, including the FSA.8

At this meeting, the industry and regulatory representatives worked to ensure that all parties had a common understanding of the extent of the problem and that they were in agreement as to the steps that would be necessary to establish a workable infrastructure going forward. Based on this, the major dealers and other industry participants gave a commitment to the regulators that they would establish, and attempt to meet, targets and deadlines for reducing confirmation and assignment backlogs (the 'steady state' processing goals). They also described the steps they would take to improve the confirmation, record-keeping and settlement process for the CDS market.

While not a part of the discussions among industry and regulatory representatives, a major participant and contributor in the post-2005 improvements in the CDS market was DTCC. Not only had DTCC already established itself as the major provider of automation services to the CDS market, having launched the Deriv/SERV automated confirmation system for credit default swaps in 2003 (see further below), but DTCC has been an established service provider to the financial services industry, having pioneered automated, centralised depository and settlement services for the equity and fixed-income markets. DTCC not only had the expertise and infrastructure to establish a core centralised depository and settlement service for both the CDS and OTC derivatives markets as a whole, but the existence and capabilities of the existing Deriv/SERV platform was a significant factor in the ability of the major dealers to establish and meet the targets they set with the regulators. Based on the precedent set in the equity and fixed-income markets, the involvement of DTCC and the creation of a central depositary infrastructure will also complement trading, operations and processing solutions offered by the vendors that support this market.

Senior oversight group

To help to promote the continued development of a sound and scalable OTC derivatives market infrastructure, and to help the major dealers meet the commitments made to regulators, the derivatives committee of the DTCC board created the global senior oversight group. The group currently consists of representatives from the 19 major dealers, along with buy-side participants selected by trade associations representing asset managers, including the Asset Management Group of the Securities Industry and Financial Markets Association (SIFMA) and the Managed Funds Association (MFA), which represents the hedge fund industry. This group has met regularly since Autumn 2005 and it has been a key driver of the progress seen in the CDS market and the OTC derivatives infrastructure. In particular, it has overseen the design and implementation of the trade information warehouse for OTC derivatives that has been implemented by DTCC (the 'DTCC warehouse').

Impact of the regulatory focus

While it would be unfair to say that the industry was caught completely unaware by the events that transpired in mid-2005 and the subsequent regulatory actions - the major dealers and other industry participants, including DTCC, had already begun to take steps to address the confirmations backlog and other processing issues - it is clear that these actions and the recommendations of the CPRMG brought the CDS-related issues facing the OTC derivatives market into sharp focus, and provided an important and definitive impetus to the steps that have since been taken towards building an appropriate infrastructure.

As a result, industry participants began to take the steps necessary to close the gap between the level of activity in the OTC derivatives market and their operational capacity to manage effectively the corresponding legal, operational and settlement risks. Among other things, this involved encouraging increased reliance on automated confirmation and clearing, development of the DTCC warehouse, and moving forward with additional initiatives and services that are aimed at standardising transactions and promoting automated solutions. Overall, these steps have specifically addressed the issues relating to the CDS market and, from the standpoint of the OTC derivatives market as a whole, have led to a marked improvement in confirmation, transaction processing and other infrastructure-related metrics.

AUTOMATION, THE DTCC WAREHOUSE AND OTHER INITIATIVES

The specific actions taken and mechanisms implemented by the major dealers, other industry participants and DTCC are described below.

Deriv/SERV and master confirmations

In July 2003, DTCC launched Deriv/SERV, its automated matching and confirmation platform, which initially focused on the CDS market. Deriv/SERV initially covered single reference entity credit default swaps issued on North American and European credits. Its functionality was subsequently expanded to handle credit default swap indices (such as iBoxx and DJ CDX), as well as credit default swaps on Asia/Pacific corporate credits and sovereign credits, and to include a payment reconciliation service. In late 2005, the service was enhanced further to include affirmation and automated matching and confirmation services for interest rate swaps and swaptions, equity swaps and variance swaps. The adoption of the Deriv/SERV platform has accelerated rapidly over the last two years.

Initially, the lack of standardised transaction templates and the lack of master confirmation agreements hindered widespread use of Deriv/SERV. While standardised transaction templates and corresponding master confirmation agreements began to gain widespread acceptance throughout 2005, users still had to execute bilateral agreements with each of their trading partners before using Deriv/SERV. This was both time-consuming and logistically challenging. In early 2006, DTCC incorporated the standard terms of these master confirmation agreements into its operating procedures, meaning that every entity signing up to use Deriv/SERV also simultaneously agreed to the terms of the master confirmation.9 This eliminated the need to have bilaterally executed master confirmation agreements.

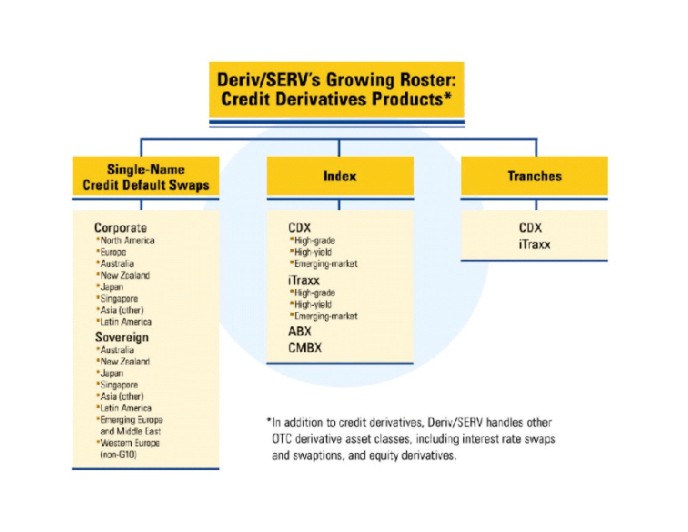

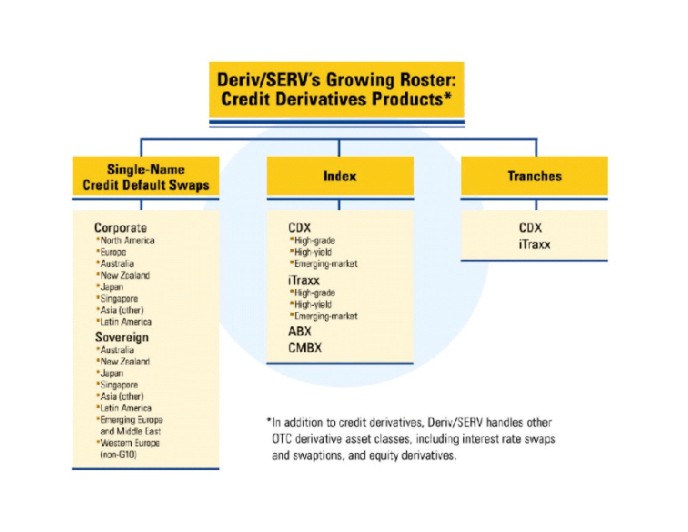

In addition to the steps taken by DTCC, the ISDA promulgated its 'Credit Derivatives Physical Settlement Matrix', which substantially reduced the trade-specific confirmation terms that must be matched or agreed to by parties to a CDS contract, and incorporated it into its 2003 Credit Derivatives Definitions (the '2003 Definitions'). DTCC undertook to support these terms on the Deriv/SERV platform, which expanded the number of transactions eligible for automated confirmation. The current scope of CDS market transactions supported by Deriv/SERV is illustrated in Figure 1.

Figure 1 Deriv/SERV's growing roster

The widespread adoption and use of Deriv/SERV has substantially increased the percentage of transactions that are confirmed on an automated basis to more than 80 per cent in 2006 - up from only 15 per cent in 2004.10 This increase has played a key role in meeting industry commitments to regulators, managing risk in the marketplace and supporting the growth of automation in the OTC derivatives market. Consistent with the foregoing, the migration of transactions to the Deriv/SERV platform has also resulted, since September 2005, in an 80 per cent decrease in those transactions that remain unconfirmed at 30 days or more after the trade date. Along with the increase in transaction volume, Deriv/SERV's global customer base grew dramatically, from 23 users in April 2004, to 753 global derivatives dealers and buy-side firms at the time of writing.11

The impact of automation and success of the Deriv/SERV platform has not only been a key factor in enabling CDS market participants to meet their commitments to regulators, but has also laid the groundwork for the development and launch of the DTCC warehouse. The combination provides a basic framework, substantially similar to that found in the cash markets, for the electronic confirmation and settlement of OTC derivative transactions, and an environment that will allow the continued development of higher level automated transaction support and processing solutions.12

The 2005 Novation Protocol

The 2005 Novation Protocol (the Protocol) was established to provide an efficient and standardised method by which to ensure that the consent of all three parties to assignments of CDS and interest rate swap transactions were obtained and recorded. The Protocol sets out a process by which the transferor, the transferee and the remaining party to a transaction will communicate prior to, or concurrent with, a transfer by novation of a covered transaction. It also provides for electronic confirmation of the agreement for the transfer. The Protocol clarifies that the effectiveness of the transfer between transferor and transferee is conditioned solely on receipt of the consent of the remaining party. In addition, the Protocol provides that if the consent of the remaining party is not received within two hours of notifying the remaining party, or if the remaining party withholds its consent, the remaining party will be deemed to have consented.

Agreement to the Protocol commits

parties to exchange a novation confirmation confirming the details of the novated trade. As a result of the implementation of the Protocol, parties no longer assign positions without the knowledge or consent of all counterparties, and the market now has a mechanism by which to ensure that firms can accurately record and actually quantify their exposure to counterparties. Aside from the obvious impact of this development on the soundness of the OTC derivatives market, the implementation of the Protocol alleviated the specific concerns raised by the CPRMG, helped to address the concerns of the regulators regarding confirmation backlogs and eliminated a major potential source of outstanding confirmations going forward.

'Steady state' processing goals

In order to provide a benchmark for measuring progress in reducing CDS market confirmation backlogs, moving forward with infrastructure improvements for the OTC derivatives market and providing a context for reporting progress to regulators, the major dealers agreed with the FRBNY, in September 2005, to promulgate and adhere to 'steady state' processing goals and standards for the CDS market. These goals are straightforward and provide that, for electronically confirmed transactions, best practice is for the parties to submit confirmations by T+1, with the outside deadline for confirming electronic transactions being T+5. The steady state goals require escalation and management review of transactions that do not meet this goal. The goal for those transactions that are not accommodated by an automated system is that the parties are to submit confirmations by T+10, to compare and sign off by T+20, with the outside deadline for confirming transactions being T+30. Again, transactions that do not meet these standards require escalation and management review.

In addition to the goal of backlog reduction, the steady state commitments made by the major dealers included expanding the use of automation and making additional improvements to the OTC derivatives market infrastructure to help to prevent future problems. A major initiative along these lines is the DTCC warehouse. The progress of the major dealers in meeting the steady state goals has been reported regularly to the FRBNY, and this is the principal basis used by the regulators for tracking the progress being made in improving CDS market metrics and the OTC derivatives infrastructure.

ISDA Cash Settlement Protocol

In September 2006, the ISDA announced its preliminary implementation of a Protocol to enable cash settlement of credit derivatives (the 'Cash Settlement Protocol'). ISDA's new Protocol permits cash settlement of single-name, index, tranche and certain other 'plain vanilla' credit (ie standardised) derivative transactions. This is an important development because, in many cases, the value of outstanding CDS contracts is greater than the aggregate value of outstanding underlying credits, making physical settlement of all contracts in the event of a default impossible. In order to promote smooth implementation of the Cash Settlement Protocol and to help to discover unanticipated issues, the preliminary settlement mechanism that has been proposed by the ISDA will be utilised for settlement of the earliest credit event under the existing 2003 Definitions and corresponding index documentation. The ISDA proposal has been built on its experience with the Calpine and Dephi defaults, and is designed to accommodate the fact that the size of notional derivatives positions will, in many cases, be greater than the value of the underlying obligations. The effectiveness of this new Protocol will be assessed on completion of the settlement process for affected trades, when that eventually happens. The cash settlement mechanism will ultimately be incorporated into a new set of Credit DerivativeDefinitions, which will also address dispute resolution for credit derivative transactions and which were originally expected to be published in 2007.13

DTCC warehouse

In early 2006, DTCC announced its plans to create a central industry trade information warehouse and support infrastructure that would automate and centralise processing of OTC derivatives contracts - the DTCC warehouse. While it was built by DTCC, the senior oversight group played a key role in both its design and implementation. The DTCC warehouse came online in November 2006 and, since then, all new trades and post-trade events submitted to Deriv/SERV for electronic confirmation, either directly or through vendor-supplied interfaces, are now automatically loaded into the DTCC warehouse.

The DTCC warehouse has two core functions. The first is to serve as a central trade information warehouse for credit derivatives that contains, by agreement of the parties, the definitive record of each OTC derivative transaction that is introduced into the Deriv/SERV environment (ie the 'golden copy'). In addition to reflecting the golden copy of an OTC derivative transaction, the DTCC warehouse has also been designed to accommodate core economic and other information for transactions that are not confirmed electronically (ie a 'bronze copy').14 The second aspect of the DTCC warehouse's core functionality is a support infrastructure that enables the standardisation and automation of post-confirmation/post-settlement processes throughout the life of each contract. The warehouse assigns a unique reference identifier for each contract and then provides a mechanism to maintain the currency of the contract terms on a real-time basis, taking into account assignments, terminations and amendments.

The DTCC warehouse both leverages and complements the automated confirmation environment that Deriv/SERV and vendor-supplied solutions support. While the trade details captured in an automated environment are the 'lifeblood' of the DTCC warehouse and have been a primary driver in its development, the ability of the warehouse to record and reflect updates to an OTC contract in a standardised manner has allowed the development of automated functionality that is above and beyond the simple confirmation of a transaction. This infrastructure will go beyond simply capturing initial transaction information to provide a comprehensive information portal, which supports automation of many processes that occur throughout a contract's life and eliminates many manual processes. The processes affected include cash flow reconciliation, credit event processing and assignment processing. At the time of writing, it was expected that, in 2007, the DTCC warehouse would expand to support central payment calculation and a central settlement capability through links with a central settlement provider to streamline payment settlement, and that it would permit the electronic reconciliation of bespoke contracts that are not currently supported in the automated environment.

In summary, the steps taken by the industry to address the concerns that gained wide attention in 2005, leading to the establishment of the Deriv/SERV–DTCC warehouse framework, have also provided a foundation for both the growth and increased automation of the CDS and broader OTC derivatives markets. This foundation will enable market participants to integrate these instruments into their mainstream operational and processing environment.

LEVERAGING THE EVOLVING CDS MARKET STRUCTURE

Perspective

While one of the principal goals involved in automating and streamlining the cash markets over the past three decades has been that of 'dematerialisation' (ie immobilising the financial instruments and any related physical indicia of ownership in a depository environment), the challenge posed by the increased use of OTC derivatives has been to provide some degree of materialisation to an asset class that, before now, had been represented only on the books and records of the parties to the transactions. The evolution of an automated confirmation and processing environment, and the development of the DTCC warehouse, have provided a framework that both captures the details of transactions and unambiguously reflects the rights of the parties to OTC derivatives transactions.

The direct impact of these changes might not be immediately evident to participants in the CDS market that currently utilise prime brokers or similar intermediaries. But they are of critical importance in meeting regulatory mandates and industry goals that have been established for the market, and they have provided the foundation for the transition of OTC derivatives into a mainstream asset class.

Automated confirmation and processing

For an OTC derivative transaction to flow automatically into the DTCC warehouse, it is necessary to utilise an automated confirmation mechanism that feeds into Deriv/SERV. Access to Deriv/SERV can be accomplished directly, or through the use of vendor-supplied platforms and services. Using the basic functionality requires very little in the way of infrastructure - it can be accessed via an Internet connection using a web browser. The challenge for the buy-side community is to take steps to ensure that the initial confirmations and subsequent events for eligible transactions are processed through Deriv/SERV.

Using and leveraging the DTCC warehouse

The DTCC warehouse has limited utility if the information simply sits there. At present, the warehouse is, for all practical purposes, principally a tool with which the major dealers can ensure that their records are in order, and a means to ensure that the industry and regulatory goals set in 2005 are being met. The long term value of the Deriv/SERV–DTCC warehouse framework, however, will be to provide the core of an operational structure that will eventually enable the OTC derivatives market to be on an operational par with the cash and exchange-traded derivatives markets. Again, buy-side participants need to start taking steps to use automated solutions that are tied into the Deriv/SERV–DTCC warehouse framework, and to integrate the warehouse information into their record-keeping and reporting structures.

The role of electronic trading platforms and other service providers

As noted extensively, the major electronic trading platforms and certain other service providers are tying their services into the Deriv/SERV–DTCC warehouse framework - but the custodian banks and auditors that support the investment management industry have not yet made material progress to integrate that framework. Drawing parallels to the cash and exchange-traded derivatives markets, it is clear that both the custodian banks and auditors must begin to incorporate the framework into their record-keeping and confirmation processes if the full benefits of the new structure are to be realised.

Achieving straight through processing (STP) for credit derivatives

The key to straight through processing (STP) is capturing information at the time at which a trade is executed and sending that information downstream in an understandable format to processing, recordkeeping and reporting systems. Also, the more complex that trade data is, the more important it is to make sure it is preserved 'up-front' in electronic form and stored downstream in a standardised format. The availability of the Deriv/SERV–DTCC warehouse platform will clearly facilitate this going forward.

Equity derivatives and other types of OTC derivatives

The developments described above, which have so far been focused principally on the CDS market, have begun to impact transactions in all OTC derivatives. Currently, the industry has begun taking steps to address processing issues surrounding both interest rate swaps and OTC equity derivatives, and to incorporate these products into the developing automated framework.

THE FUTURE OF OTC DERIVATIVES AND CONVERGENCE WITH OTHER MARKETS

Growth of the CDS and OTC derivatives markets

The emergence and rapid growth of the CDS market reflects a logical approach to the fragmentation, price discovery and transparency issues that have always been a factor in the credit markets. Due to the overheads associated with OTC derivative transactions, however, the emergence of the CDS market and the expansion of the broader OTC derivatives market required the development of communications, pricing and other basic infrastructures that did not even exist two decades ago. While CDS and other OTC derivative transactions are inherently more difficult to initiate, record and process than either cash market transactions or transactions in exchange-traded derivatives, they offer investors a great deal of flexibility, and the evidence so far is that market participants are willing to bear the costs that are associated with this flexibility. In addition, the emergence of an automated infrastructure, combined with a centralised depository and settlement facility, will ultimately reduce these costs, while at the same time providing a ready framework for new derivatives products.

The future of OTC derivatives

There is a great deal of debate about the risks and benefits of OTC derivatives. Detractors make negative predictions about this market, but fail generally to point to present problems that might be attributed to this market, focusing instead on potential issues.15 On the other hand, those who believe that the growth of this market has been a positive development point out that, to date, the evidence is that the use of derivatives to transfer risk has resulted in a paradigm shift for the credit markets, leading to a lower default environment, reduced volatility and lower funding costs for borrowers.16 In this regard, there are significant parallels between the growth and impact of the CDS market, and the impact that futures markets and insurance markets have had in the past as they became more efficient at enabling the identification, transfer and pricing of risk. In all of these cases, development of this ability has had a profound and positive impact on the stability of the related markets.

Convergence and co-existence

Taking into account the factors described above, it is difficult to see why market participants would abandon OTC derivatives. Even though the futures markets plan to offer credit-based products,17 this is not going to displace the CDS market overnight (if it does so at all). Also, it is unlikely that exchange-based products will ever offer the flexibility of OTC derivatives. The more likely outcome is that the OTC derivatives market infrastructure will continue to develop, and that credit derivatives and other OTC derivatives will more and more be seen as a mainstream asset class for institutional investors.

CONCLUSION

The CDS market has emerged and the broader OTC derivatives market has grown because they fill a natural gap that is created by the nature and limitations of the cash markets for credit instruments, on the one hand, and the relatively rigid trading structure of the exchange-traded derivative markets, on the other. While this gap has existed for some time, the emergence of the CDS market and the expansion of the broader OTC derivatives market required the development of communications, pricing and other basic infrastructures that did not even exist two decades ago. Because of the flexibility that OTC derivatives offer, the development of an automated processing and central depositary structure, coupled with the likelihood that the electronic trading networks, custodians and other service providers will embrace this new structure, it appears that the OTC derivatives market will continue to grow and that OTC derivatives will become increasingly integrated into the broader market structure as a mainstream, widely accepted asset class. It is therefore critical for buy-side market participants, along with the vendors and service providers that support them, to understand fully the significant changes that have been made to the OTC derivatives market infrastructure and to integrate this structure into their businesses.

© James P. Wallin, 2007

REFERENCES

(1) The term 'credit derivatives' herein is meant to refer to credit default swaps, which are bilateral, over-the-counter contracts in which the seller agrees to make a payment to the buyer in the event of a specified credit event (involving a single issuer, a group of issuers - ie a 'tranche' - or issuers comprising a specified index) in exchange for a fixed payment or series of fixed payments.

(2) TradeWeb and SWAPSWire, among others, currently provide, or are in the process of developing, solutions that not only both leverage and integrate the Deriv/SERV–DTCC warehouse framework, but also provide functionality that addresses straight through processing (STP) and allocation issues.

(3) Thomas Huertas, director, Wholesale Firms Division and Banking Sector Leader, FSA (2006) Credit Derivatives: Boon to Mankind or Accident Waiting to Happen?, Speech at Rhombus Research Annual Conference, London, 26th April, available online at http://www.fsa.gov.uk/pages/Library/Communication/Speeches/2006/0426_th.shtml.

(4) Michael Hudson and Serena Ng (2006) 'Greenspan expresses concerns on derivatives, Medicare costs', Wall Street Journal, 19th May.

(5) Bank of England (2005) Financial Stability Review, Issue 19, December, available online at http://www.bankofengland.co.uk/publications/fsr/2005/fsrfull0512.pdf.

(6) The CPRMG is a group of major market participants, including the major dealers in credit derivatives.

(7) CPRMG (2005) Toward Greater Financial Stability: A Private Sector Perspective, 27th July, available online at http://www.crmpolicygroup.org/.

(8) Hamish Risk and Justin Baer (2005) 'Fed summons 14 banks to discuss credit-derivatives controls', Bloomberg.com, 24th August, available online at http://www.bloomberg.com/apps/news?pid=10000087&sid=aCcyORCwEhVw&refer=top_world_news.

(9) It is interesting to note that, while similar to the situation that exists with master ISDAs, many counterparties were held back from being able to execute master confirmations by the fact that the documents were, at times, subject to extensive legal review; this need apparently disappeared when the corresponding terms were incorporated into the Deriv/SERV operating procedures as standard language. For this reason alone, the approach taken here merits a second look to see where else in the ISDA-master drafting process it might be applicable.

(10) Structured Credit Investor (2007) 'DTCC triples volume and rebates US$3m', Issue 30, 14th March, available online at http://www.structuredcreditinvestor.com/story.asp?PubID=250&ISS=22095&SID=15732.

(11) DTCC (2006) Annual Report: Putting Customers First, available online at http://www.dtcc.com/downloads/annuals/2006/2006_report.pdf.

(12) While, as noted above, certain vendors offer services that provide comprehensive record-keeping and reporting solutions for OTC derivatives, there is, in the author's view, a necessary dichotomy between the higher level and varied nature of the services that are provided by these vendors and the basic infrastructure - in this case, that provided by the Deriv/SERV–DTCC warehouse framework - that both captures the basic details and unambiguously reflects the rights of the parties to an OTC derivatives transaction.

(13) ISDA (2006) ISDA Pledges Continued Operational Innovation; Facilitates Cash Settlement For Credit Derivatives, News release, 27th September, available online at http://www.isda.org/press/press092706cashsettlement.html.

(14) The fate of the 'silver copy' has become the subject of much debate among members of the senior oversight group and other market participants.

(15) See, eg, Matthew Lynn (2006) 'Investing: failing vision for Oracle of Omaha?', International Herald Tribune/Marketplace by Bloomberg, 13th March, available online at http://www.iht.com/articles/2006/03/12/bloomberg/bxinvest.php.

(16) On the other hand, see Alan Greenspan (2005) Risk Transfer and Financial Stability, Speech to the Federal Reserve Bank of Chicago's 41st Annual Conference on Bank Structure, Chicago, IL, 5th May, available online at http://www.federalreserve.gov/Boarddocs/Speeches/2005/20050505/default.htm.

(17) Chicago Mercantile Exchange Holdings Inc., the largest US futures market; the Chicago Board Options Exchange; and Frankfurt-based Eurex AG. For example, Euronext NV, which is being bought by NYSE Group Inc., plans to create contracts based on credit-default swaps, making them cheaper to trade and easier to understand than the derivatives sold by banks.

This site, like many others, uses small files called cookies to customize your experience. Cookies appear to be blocked on this browser. Please consider allowing cookies so that you can enjoy more content across fundservices.net.

How do I enable cookies in my browser?

Internet Explorer

1. Click the Tools button (or press ALT and T on the keyboard), and then click Internet Options.

2. Click the Privacy tab

3. Move the slider away from 'Block all cookies' to a setting you're comfortable with.

Firefox

1. At the top of the Firefox window, click on the Tools menu and select Options...

2. Select the Privacy panel.

3. Set Firefox will: to Use custom settings for history.

4. Make sure Accept cookies from sites is selected.

Safari Browser

1. Click Safari icon in Menu Bar

2. Click Preferences (gear icon)

3. Click Security icon

4. Accept cookies: select Radio button "only from sites I visit"

Chrome

1. Click the menu icon to the right of the address bar (looks like 3 lines)

2. Click Settings

3. Click the "Show advanced settings" tab at the bottom

4. Click the "Content settings..." button in the Privacy section

5. At the top under Cookies make sure it is set to "Allow local data to be set (recommended)"

Opera

1. Click the red O button in the upper left hand corner

2. Select Settings -> Preferences

3. Select the Advanced Tab

4. Select Cookies in the list on the left side

5. Set it to "Accept cookies" or "Accept cookies only from the sites I visit"

6. Click OK

James Wallin joined AllianceBernstein Fixed Income in 2005, prior to which he was at Morgan Stanley Investment Management. James graduated from the State University of New York at Stony Brook in 1980 and received a Juris Doctor degree from New York Law School in 1983. He is a member of the New York Bar and a Solicitor of the Supreme Court of England and Wales. Prior to working at Morgan Stanley, James had been senior counsel at Evergreen Asset Management Corp., and general counsel and chief administrative officer at Yamaichi Capital Management Inc. He also worked in the legal department of The Dreyfus Corporation, and with the law firm of Cole and Dietz (now Winston and Strawn). James had also worked at Alliance Capital on a previous occasion, between 1982 and 1986. He is a member of the steering committee for the Securities Industry and Financial Markets Association (SIFMA) Asset Management Group and a buy-side representative on the Depository Trust and Clearing Corporation (DTCC)-sponsored global senior oversight group that is focusing on over-the-counter (OTC) derivatives-related processing and infrastructure issues.

ABSTRACT

This paper addresses current issues in the over-the-counter (OTC) derivatives processing arena, with a focus on credit derivatives. It describes the approach that has been adopted by regulators and the industry to deal with the explosive growth of this market, along with the processing and infrastructure issues that have arisen in connection with this growth. It also describes the industry responses to input regarding these issues from regulators in the USA and the UK. In addition to describing the history of the market and the rapid growth it has experienced in recent years, particular focus is given to the steps taken by the major dealers in OTC derivatives, the Depository Trust and Clearing Corporation (DTCC) and vendors that support the market to address the processing backlog and to put in place a scalable infrastructure that will support this business going forward. In this context, the author attempts to present these issues from a buy-side perspective, both to illustrate the issues and solutions to a broad audience, and to encourage buy-side participants in this market, along with their service providers, to embrace fully the change that has taken place. Particular attention is paid to the development by DTCC of the DTCC Warehouse, the Deriv/SERV confirmation and maintenance platform for OTC derivative transactions, and emerging vendor solutions for OTC derivatives processing, along with suggestions as to how industry participants can utilise these services.

Keywords: credit default swap, over-the-counter (OTC) derivatives, credit derivatives (CDS) market, Depository Trust and Clearing Corporation (DTCC), Deriv/SERV, Federal Reserve, Federal Reserve Bank of New York (FRBNY), Bank of England, International Swaps and Derivatives Association Inc. (ISDA), novation, cash settlement, convergence, senior oversight group, steady state, Securities Industry and Financial Markets Association (SIFMA), Managed Funds Association (MFA), straight through processing (STP)

OVERVIEW

The credit derivatives (CDS) market1 has grown explosively over the last decade and has become an important - and integral - component of the worldwide financial structure. While the purpose of this paper is to acquaint readers with the infrastructure improvements made in the CDS market over the past several years, and to provide insight into how to leverage these improvements, in particular, and into the trade information warehouse developed by the Depository Trust and Clearing Corporation (DTCC), the Deriv/SERV service and emerging vendor solutions, it is also important for industry participants to have a full awareness of the events that prompted these improvements and the respective roles of the participants in this process. With this understanding, industry participants can better work towards establishing best practice and can gauge more effectively the importance of integrating these improvements into their processing, recordkeeping and reporting infrastructure.

THE CREDIT DERIVATIVES (CDS) MARKET

From its emergence in 1996 to the present day, the CDS market has grown exponentially, totalling US$20.2tn in outstanding contracts at the end of 2006. Projections suggest that the growth will continue and will reach US$33.1tn in outstanding contracts by 2008.

Many factors have contributed to the phenomenal growth of the CDS market. From an economic standpoint, these include:

- the ability to gain off-balance-sheet leverage;

- increased liquidity and ready access to credit exposure;

- increased price transparency versus cash instruments;

- enhanced price discovery; and

- access to index and tranche products that provide broad credit exposure.

While the operations and processing improvements implemented in the over-the- counter (OTC) derivatives market prior to 2005 were significant steps forward, the OTC derivatives infrastructure did not keep pace with the market's growth. This stems not only from the fact that participants in the OTC derivatives market expect transactions to be tailored to meet individual needs, but also from the fact that the phenomenal increases in volume experienced by the CDS and the OTC derivatives markets overall were unanticipated, and were not supported by a centralised and automated infrastructure.

In this environment, the ability of the dealers to process transactions lagged behind the increasing volume. By mid-2005, there were over 150,000 unconfirmed credit derivatives transactions.3 This alone illustrates the clear disconnect between the size and importance of the CDS market, on one hand, and the state of the confirmation, record-keeping and processing side of the business, on the other.

Comments made by Alan Greenspan, former chairman of the Federal Reserve Bank of New York (FRBNY), clearly - and perhaps painfully - brought to light the problems of the rapid growth of the CDS market. While Greenspan has consistently expressed his belief that credit derivatives have played a positive role in the global marketplace and economy, in May 2006, he stated that he was 'frankly shocked' by CDS market trading mechanics and characterised the trading environment as one in which 'traders often buy and sell these instruments, known as credit-default swaps, over the phone without confirming their trades and relying on scraps of paper to record the details'.4

Greenspan's observations offer an important context. In particular, he illuminates the reality that it is impossible to expect the economic goals of participants in the OTC derivatives market to be met without ensuring that an appropriate infrastructure is in place. Participants in this market are not holders of instruments that have an independent legal existence, which can be bought and sold with little overhead or difficulty in an established market structure. The OTC derivatives is based on individually negotiated, bilateral contracts that have to be properly recorded, accounted for and confirmed with the other party, or parties, at each step of the trading and maintenance process. In contrast to the infrastructure challenges that are faced by other segments of the financial markets, the OTC derivatives market is unique in that, until recently, there was no mechanism independent of the parties for recording the particulars of a transaction.

By mid-2005, the state of affairs referred to by Greenspan, focusing, in particular, on the CDS market, had already become clear to both the regulators and the industry. Fortunately, the joint industry and regulatory response has, since then, led to innovative and meaningful change. The changes we have seen, along with those that will be implemented later this year and in future, will continue to support the growth of credit derivatives as an asset class. These changes will also support and enhance the stability, and growth, of the OTC derivatives market in general.

INDUSTRY AND REGULATORY ACTIONS SINCE 2005

The OTC derivatives market is an unregulated market that is based upon privately negotiated, bilateral contracts, which are entered into by sophisticated parties. The CDS market is part of this market, and its structure evolved within the existing framework for interest rate swaps and other privately negotiated derivatives, which is based predominantly on documentation promulgated by the International Swaps and Derivatives Association Inc. (ISDA). The individual participants in the market and the transactions that take place between the participants are not subject to any specific regulatory regime on a day-to-day basis.

Given this background, the impetus for the regulators' interest in this market and the nexus for their involvement was the concern that a series of major corporate credit events, while unlikely, might pose substantial risks to financial markets if the CDS market infrastructure were not to reflect accurately the outstanding obligations and liabilities of the participants. The regulators felt that a major credit event, coupled with a breakdown in the CDS market infrastructure, would not only be disruptive to participants in that market - including major banks and insurers, who rely heavily on credit protection - but could have significant ripple effects in the broader economy.

The regulatory alarm first sounded in February 2005, when the UK Financial Services Authority (FSA) called for steps via which to tackle the level of outstanding incomplete confirmations for credit derivatives.5 In July 2005, the Counterparty Risk Management Policy Group (CPRMG)6 issued a report that also called for firms to address this backlog, and to develop electronic trade matching and confirmation generation systems.7 The CPRMG also raised concern regarding the issues arising from assignments of credit derivatives, calling, in particular, for the establishment of a mechanism that would ensure that the consent of all three parties to an assignment had been obtained and properly recorded at the time of the assignment. The definitive regulatory step was taken by the Federal Reserve Bank of New York (FRBNY) in September 2005, when it arranged a meeting in New York that was attended by 14 of the major dealers in credit derivatives (the 'major dealers') and 14 financial services regulators, including the FSA.8

At this meeting, the industry and regulatory representatives worked to ensure that all parties had a common understanding of the extent of the problem and that they were in agreement as to the steps that would be necessary to establish a workable infrastructure going forward. Based on this, the major dealers and other industry participants gave a commitment to the regulators that they would establish, and attempt to meet, targets and deadlines for reducing confirmation and assignment backlogs (the 'steady state' processing goals). They also described the steps they would take to improve the confirmation, record-keeping and settlement process for the CDS market.

While not a part of the discussions among industry and regulatory representatives, a major participant and contributor in the post-2005 improvements in the CDS market was DTCC. Not only had DTCC already established itself as the major provider of automation services to the CDS market, having launched the Deriv/SERV automated confirmation system for credit default swaps in 2003 (see further below), but DTCC has been an established service provider to the financial services industry, having pioneered automated, centralised depository and settlement services for the equity and fixed-income markets. DTCC not only had the expertise and infrastructure to establish a core centralised depository and settlement service for both the CDS and OTC derivatives markets as a whole, but the existence and capabilities of the existing Deriv/SERV platform was a significant factor in the ability of the major dealers to establish and meet the targets they set with the regulators. Based on the precedent set in the equity and fixed-income markets, the involvement of DTCC and the creation of a central depositary infrastructure will also complement trading, operations and processing solutions offered by the vendors that support this market.

Senior oversight group

To help to promote the continued development of a sound and scalable OTC derivatives market infrastructure, and to help the major dealers meet the commitments made to regulators, the derivatives committee of the DTCC board created the global senior oversight group. The group currently consists of representatives from the 19 major dealers, along with buy-side participants selected by trade associations representing asset managers, including the Asset Management Group of the Securities Industry and Financial Markets Association (SIFMA) and the Managed Funds Association (MFA), which represents the hedge fund industry. This group has met regularly since Autumn 2005 and it has been a key driver of the progress seen in the CDS market and the OTC derivatives infrastructure. In particular, it has overseen the design and implementation of the trade information warehouse for OTC derivatives that has been implemented by DTCC (the 'DTCC warehouse').

Impact of the regulatory focus

While it would be unfair to say that the industry was caught completely unaware by the events that transpired in mid-2005 and the subsequent regulatory actions - the major dealers and other industry participants, including DTCC, had already begun to take steps to address the confirmations backlog and other processing issues - it is clear that these actions and the recommendations of the CPRMG brought the CDS-related issues facing the OTC derivatives market into sharp focus, and provided an important and definitive impetus to the steps that have since been taken towards building an appropriate infrastructure.

As a result, industry participants began to take the steps necessary to close the gap between the level of activity in the OTC derivatives market and their operational capacity to manage effectively the corresponding legal, operational and settlement risks. Among other things, this involved encouraging increased reliance on automated confirmation and clearing, development of the DTCC warehouse, and moving forward with additional initiatives and services that are aimed at standardising transactions and promoting automated solutions. Overall, these steps have specifically addressed the issues relating to the CDS market and, from the standpoint of the OTC derivatives market as a whole, have led to a marked improvement in confirmation, transaction processing and other infrastructure-related metrics.

AUTOMATION, THE DTCC WAREHOUSE AND OTHER INITIATIVES

The specific actions taken and mechanisms implemented by the major dealers, other industry participants and DTCC are described below.

Deriv/SERV and master confirmations

In July 2003, DTCC launched Deriv/SERV, its automated matching and confirmation platform, which initially focused on the CDS market. Deriv/SERV initially covered single reference entity credit default swaps issued on North American and European credits. Its functionality was subsequently expanded to handle credit default swap indices (such as iBoxx and DJ CDX), as well as credit default swaps on Asia/Pacific corporate credits and sovereign credits, and to include a payment reconciliation service. In late 2005, the service was enhanced further to include affirmation and automated matching and confirmation services for interest rate swaps and swaptions, equity swaps and variance swaps. The adoption of the Deriv/SERV platform has accelerated rapidly over the last two years.

Initially, the lack of standardised transaction templates and the lack of master confirmation agreements hindered widespread use of Deriv/SERV. While standardised transaction templates and corresponding master confirmation agreements began to gain widespread acceptance throughout 2005, users still had to execute bilateral agreements with each of their trading partners before using Deriv/SERV. This was both time-consuming and logistically challenging. In early 2006, DTCC incorporated the standard terms of these master confirmation agreements into its operating procedures, meaning that every entity signing up to use Deriv/SERV also simultaneously agreed to the terms of the master confirmation.9 This eliminated the need to have bilaterally executed master confirmation agreements.

In addition to the steps taken by DTCC, the ISDA promulgated its 'Credit Derivatives Physical Settlement Matrix', which substantially reduced the trade-specific confirmation terms that must be matched or agreed to by parties to a CDS contract, and incorporated it into its 2003 Credit Derivatives Definitions (the '2003 Definitions'). DTCC undertook to support these terms on the Deriv/SERV platform, which expanded the number of transactions eligible for automated confirmation. The current scope of CDS market transactions supported by Deriv/SERV is illustrated in Figure 1.

Figure 1 Deriv/SERV's growing roster

The widespread adoption and use of Deriv/SERV has substantially increased the percentage of transactions that are confirmed on an automated basis to more than 80 per cent in 2006 - up from only 15 per cent in 2004.10 This increase has played a key role in meeting industry commitments to regulators, managing risk in the marketplace and supporting the growth of automation in the OTC derivatives market. Consistent with the foregoing, the migration of transactions to the Deriv/SERV platform has also resulted, since September 2005, in an 80 per cent decrease in those transactions that remain unconfirmed at 30 days or more after the trade date. Along with the increase in transaction volume, Deriv/SERV's global customer base grew dramatically, from 23 users in April 2004, to 753 global derivatives dealers and buy-side firms at the time of writing.11

The impact of automation and success of the Deriv/SERV platform has not only been a key factor in enabling CDS market participants to meet their commitments to regulators, but has also laid the groundwork for the development and launch of the DTCC warehouse. The combination provides a basic framework, substantially similar to that found in the cash markets, for the electronic confirmation and settlement of OTC derivative transactions, and an environment that will allow the continued development of higher level automated transaction support and processing solutions.12

The 2005 Novation Protocol

The 2005 Novation Protocol (the Protocol) was established to provide an efficient and standardised method by which to ensure that the consent of all three parties to assignments of CDS and interest rate swap transactions were obtained and recorded. The Protocol sets out a process by which the transferor, the transferee and the remaining party to a transaction will communicate prior to, or concurrent with, a transfer by novation of a covered transaction. It also provides for electronic confirmation of the agreement for the transfer. The Protocol clarifies that the effectiveness of the transfer between transferor and transferee is conditioned solely on receipt of the consent of the remaining party. In addition, the Protocol provides that if the consent of the remaining party is not received within two hours of notifying the remaining party, or if the remaining party withholds its consent, the remaining party will be deemed to have consented.

Agreement to the Protocol commits

parties to exchange a novation confirmation confirming the details of the novated trade. As a result of the implementation of the Protocol, parties no longer assign positions without the knowledge or consent of all counterparties, and the market now has a mechanism by which to ensure that firms can accurately record and actually quantify their exposure to counterparties. Aside from the obvious impact of this development on the soundness of the OTC derivatives market, the implementation of the Protocol alleviated the specific concerns raised by the CPRMG, helped to address the concerns of the regulators regarding confirmation backlogs and eliminated a major potential source of outstanding confirmations going forward.

'Steady state' processing goals

In order to provide a benchmark for measuring progress in reducing CDS market confirmation backlogs, moving forward with infrastructure improvements for the OTC derivatives market and providing a context for reporting progress to regulators, the major dealers agreed with the FRBNY, in September 2005, to promulgate and adhere to 'steady state' processing goals and standards for the CDS market. These goals are straightforward and provide that, for electronically confirmed transactions, best practice is for the parties to submit confirmations by T+1, with the outside deadline for confirming electronic transactions being T+5. The steady state goals require escalation and management review of transactions that do not meet this goal. The goal for those transactions that are not accommodated by an automated system is that the parties are to submit confirmations by T+10, to compare and sign off by T+20, with the outside deadline for confirming transactions being T+30. Again, transactions that do not meet these standards require escalation and management review.

In addition to the goal of backlog reduction, the steady state commitments made by the major dealers included expanding the use of automation and making additional improvements to the OTC derivatives market infrastructure to help to prevent future problems. A major initiative along these lines is the DTCC warehouse. The progress of the major dealers in meeting the steady state goals has been reported regularly to the FRBNY, and this is the principal basis used by the regulators for tracking the progress being made in improving CDS market metrics and the OTC derivatives infrastructure.

ISDA Cash Settlement Protocol

In September 2006, the ISDA announced its preliminary implementation of a Protocol to enable cash settlement of credit derivatives (the 'Cash Settlement Protocol'). ISDA's new Protocol permits cash settlement of single-name, index, tranche and certain other 'plain vanilla' credit (ie standardised) derivative transactions. This is an important development because, in many cases, the value of outstanding CDS contracts is greater than the aggregate value of outstanding underlying credits, making physical settlement of all contracts in the event of a default impossible. In order to promote smooth implementation of the Cash Settlement Protocol and to help to discover unanticipated issues, the preliminary settlement mechanism that has been proposed by the ISDA will be utilised for settlement of the earliest credit event under the existing 2003 Definitions and corresponding index documentation. The ISDA proposal has been built on its experience with the Calpine and Dephi defaults, and is designed to accommodate the fact that the size of notional derivatives positions will, in many cases, be greater than the value of the underlying obligations. The effectiveness of this new Protocol will be assessed on completion of the settlement process for affected trades, when that eventually happens. The cash settlement mechanism will ultimately be incorporated into a new set of Credit DerivativeDefinitions, which will also address dispute resolution for credit derivative transactions and which were originally expected to be published in 2007.13

DTCC warehouse

In early 2006, DTCC announced its plans to create a central industry trade information warehouse and support infrastructure that would automate and centralise processing of OTC derivatives contracts - the DTCC warehouse. While it was built by DTCC, the senior oversight group played a key role in both its design and implementation. The DTCC warehouse came online in November 2006 and, since then, all new trades and post-trade events submitted to Deriv/SERV for electronic confirmation, either directly or through vendor-supplied interfaces, are now automatically loaded into the DTCC warehouse.

The DTCC warehouse has two core functions. The first is to serve as a central trade information warehouse for credit derivatives that contains, by agreement of the parties, the definitive record of each OTC derivative transaction that is introduced into the Deriv/SERV environment (ie the 'golden copy'). In addition to reflecting the golden copy of an OTC derivative transaction, the DTCC warehouse has also been designed to accommodate core economic and other information for transactions that are not confirmed electronically (ie a 'bronze copy').14 The second aspect of the DTCC warehouse's core functionality is a support infrastructure that enables the standardisation and automation of post-confirmation/post-settlement processes throughout the life of each contract. The warehouse assigns a unique reference identifier for each contract and then provides a mechanism to maintain the currency of the contract terms on a real-time basis, taking into account assignments, terminations and amendments.

The DTCC warehouse both leverages and complements the automated confirmation environment that Deriv/SERV and vendor-supplied solutions support. While the trade details captured in an automated environment are the 'lifeblood' of the DTCC warehouse and have been a primary driver in its development, the ability of the warehouse to record and reflect updates to an OTC contract in a standardised manner has allowed the development of automated functionality that is above and beyond the simple confirmation of a transaction. This infrastructure will go beyond simply capturing initial transaction information to provide a comprehensive information portal, which supports automation of many processes that occur throughout a contract's life and eliminates many manual processes. The processes affected include cash flow reconciliation, credit event processing and assignment processing. At the time of writing, it was expected that, in 2007, the DTCC warehouse would expand to support central payment calculation and a central settlement capability through links with a central settlement provider to streamline payment settlement, and that it would permit the electronic reconciliation of bespoke contracts that are not currently supported in the automated environment.

In summary, the steps taken by the industry to address the concerns that gained wide attention in 2005, leading to the establishment of the Deriv/SERV–DTCC warehouse framework, have also provided a foundation for both the growth and increased automation of the CDS and broader OTC derivatives markets. This foundation will enable market participants to integrate these instruments into their mainstream operational and processing environment.

LEVERAGING THE EVOLVING CDS MARKET STRUCTURE

Perspective

While one of the principal goals involved in automating and streamlining the cash markets over the past three decades has been that of 'dematerialisation' (ie immobilising the financial instruments and any related physical indicia of ownership in a depository environment), the challenge posed by the increased use of OTC derivatives has been to provide some degree of materialisation to an asset class that, before now, had been represented only on the books and records of the parties to the transactions. The evolution of an automated confirmation and processing environment, and the development of the DTCC warehouse, have provided a framework that both captures the details of transactions and unambiguously reflects the rights of the parties to OTC derivatives transactions.

The direct impact of these changes might not be immediately evident to participants in the CDS market that currently utilise prime brokers or similar intermediaries. But they are of critical importance in meeting regulatory mandates and industry goals that have been established for the market, and they have provided the foundation for the transition of OTC derivatives into a mainstream asset class.

Automated confirmation and processing

For an OTC derivative transaction to flow automatically into the DTCC warehouse, it is necessary to utilise an automated confirmation mechanism that feeds into Deriv/SERV. Access to Deriv/SERV can be accomplished directly, or through the use of vendor-supplied platforms and services. Using the basic functionality requires very little in the way of infrastructure - it can be accessed via an Internet connection using a web browser. The challenge for the buy-side community is to take steps to ensure that the initial confirmations and subsequent events for eligible transactions are processed through Deriv/SERV.

Using and leveraging the DTCC warehouse

The DTCC warehouse has limited utility if the information simply sits there. At present, the warehouse is, for all practical purposes, principally a tool with which the major dealers can ensure that their records are in order, and a means to ensure that the industry and regulatory goals set in 2005 are being met. The long term value of the Deriv/SERV–DTCC warehouse framework, however, will be to provide the core of an operational structure that will eventually enable the OTC derivatives market to be on an operational par with the cash and exchange-traded derivatives markets. Again, buy-side participants need to start taking steps to use automated solutions that are tied into the Deriv/SERV–DTCC warehouse framework, and to integrate the warehouse information into their record-keeping and reporting structures.

The role of electronic trading platforms and other service providers

As noted extensively, the major electronic trading platforms and certain other service providers are tying their services into the Deriv/SERV–DTCC warehouse framework - but the custodian banks and auditors that support the investment management industry have not yet made material progress to integrate that framework. Drawing parallels to the cash and exchange-traded derivatives markets, it is clear that both the custodian banks and auditors must begin to incorporate the framework into their record-keeping and confirmation processes if the full benefits of the new structure are to be realised.

Achieving straight through processing (STP) for credit derivatives

The key to straight through processing (STP) is capturing information at the time at which a trade is executed and sending that information downstream in an understandable format to processing, recordkeeping and reporting systems. Also, the more complex that trade data is, the more important it is to make sure it is preserved 'up-front' in electronic form and stored downstream in a standardised format. The availability of the Deriv/SERV–DTCC warehouse platform will clearly facilitate this going forward.

Equity derivatives and other types of OTC derivatives

The developments described above, which have so far been focused principally on the CDS market, have begun to impact transactions in all OTC derivatives. Currently, the industry has begun taking steps to address processing issues surrounding both interest rate swaps and OTC equity derivatives, and to incorporate these products into the developing automated framework.

THE FUTURE OF OTC DERIVATIVES AND CONVERGENCE WITH OTHER MARKETS

Growth of the CDS and OTC derivatives markets

The emergence and rapid growth of the CDS market reflects a logical approach to the fragmentation, price discovery and transparency issues that have always been a factor in the credit markets. Due to the overheads associated with OTC derivative transactions, however, the emergence of the CDS market and the expansion of the broader OTC derivatives market required the development of communications, pricing and other basic infrastructures that did not even exist two decades ago. While CDS and other OTC derivative transactions are inherently more difficult to initiate, record and process than either cash market transactions or transactions in exchange-traded derivatives, they offer investors a great deal of flexibility, and the evidence so far is that market participants are willing to bear the costs that are associated with this flexibility. In addition, the emergence of an automated infrastructure, combined with a centralised depository and settlement facility, will ultimately reduce these costs, while at the same time providing a ready framework for new derivatives products.

The future of OTC derivatives

There is a great deal of debate about the risks and benefits of OTC derivatives. Detractors make negative predictions about this market, but fail generally to point to present problems that might be attributed to this market, focusing instead on potential issues.15 On the other hand, those who believe that the growth of this market has been a positive development point out that, to date, the evidence is that the use of derivatives to transfer risk has resulted in a paradigm shift for the credit markets, leading to a lower default environment, reduced volatility and lower funding costs for borrowers.16 In this regard, there are significant parallels between the growth and impact of the CDS market, and the impact that futures markets and insurance markets have had in the past as they became more efficient at enabling the identification, transfer and pricing of risk. In all of these cases, development of this ability has had a profound and positive impact on the stability of the related markets.

Convergence and co-existence

Taking into account the factors described above, it is difficult to see why market participants would abandon OTC derivatives. Even though the futures markets plan to offer credit-based products,17 this is not going to displace the CDS market overnight (if it does so at all). Also, it is unlikely that exchange-based products will ever offer the flexibility of OTC derivatives. The more likely outcome is that the OTC derivatives market infrastructure will continue to develop, and that credit derivatives and other OTC derivatives will more and more be seen as a mainstream asset class for institutional investors.

CONCLUSION

The CDS market has emerged and the broader OTC derivatives market has grown because they fill a natural gap that is created by the nature and limitations of the cash markets for credit instruments, on the one hand, and the relatively rigid trading structure of the exchange-traded derivative markets, on the other. While this gap has existed for some time, the emergence of the CDS market and the expansion of the broader OTC derivatives market required the development of communications, pricing and other basic infrastructures that did not even exist two decades ago. Because of the flexibility that OTC derivatives offer, the development of an automated processing and central depositary structure, coupled with the likelihood that the electronic trading networks, custodians and other service providers will embrace this new structure, it appears that the OTC derivatives market will continue to grow and that OTC derivatives will become increasingly integrated into the broader market structure as a mainstream, widely accepted asset class. It is therefore critical for buy-side market participants, along with the vendors and service providers that support them, to understand fully the significant changes that have been made to the OTC derivatives market infrastructure and to integrate this structure into their businesses.

© James P. Wallin, 2007

REFERENCES

(1) The term 'credit derivatives' herein is meant to refer to credit default swaps, which are bilateral, over-the-counter contracts in which the seller agrees to make a payment to the buyer in the event of a specified credit event (involving a single issuer, a group of issuers - ie a 'tranche' - or issuers comprising a specified index) in exchange for a fixed payment or series of fixed payments.

(2) TradeWeb and SWAPSWire, among others, currently provide, or are in the process of developing, solutions that not only both leverage and integrate the Deriv/SERV–DTCC warehouse framework, but also provide functionality that addresses straight through processing (STP) and allocation issues.

(3) Thomas Huertas, director, Wholesale Firms Division and Banking Sector Leader, FSA (2006) Credit Derivatives: Boon to Mankind or Accident Waiting to Happen?, Speech at Rhombus Research Annual Conference, London, 26th April, available online at http://www.fsa.gov.uk/pages/Library/Communication/Speeches/2006/0426_th.shtml.

(4) Michael Hudson and Serena Ng (2006) 'Greenspan expresses concerns on derivatives, Medicare costs', Wall Street Journal, 19th May.

(5) Bank of England (2005) Financial Stability Review, Issue 19, December, available online at http://www.bankofengland.co.uk/publications/fsr/2005/fsrfull0512.pdf.

(6) The CPRMG is a group of major market participants, including the major dealers in credit derivatives.

(7) CPRMG (2005) Toward Greater Financial Stability: A Private Sector Perspective, 27th July, available online at http://www.crmpolicygroup.org/.