Post-trade activities play a critical role. The safety and efficiency of the arrangements required to finalize securities transactions lie at the core of modern capital markets and are indispensable for their proper functioning. But clearing and settlement often operate in vertical silos, and are frequently too costly or complex, which serves to discourage trading and investment. A range of fixes are in play and, with Europe the principal focal point, we speak with Hugh Palmer of Societe Generale Securities Services (SGSS).

The key developments in Europe comprise a recent switch to T+2 settlement, along with enhancement of settlement discipline and asset safety under the European Union's 2014 Central Securities Depositories Regulation (CSDR). Soon to go live is Target2-Securities (T2S) which will integrate Europe's fragmented settlement and safekeeping infrastructure, and pool resources. These changes will create developed, reliable and effective capital markets in the region, through driving up efficiency and boosting cross-border investment.

Behind these initiatives is the Giovannini Group of financial-market participants, which was established in 1996 to advise the European Commission. In a 2001 report, the Group identified a total of 15 barriers to efficient cross-border clearing and settlement in the European Union. Together, CSDR and T2S contribute to the elimination of nine of the barriers.

In October 2014, a reduction in settlement timeframes to a standard T+2 cycle took effect in the vast majority of markets across the wider Europe. Initiated by the CSDR, this was achieved because of a huge effort on the part of central banks, regulators, market infrastructure bodies and custodian banks across 22 markets. The transition went smoothly, thanks to good planning by operations teams at asset managers and broker-dealers. In Europe, T+2 is now business as usual and seen as a great success which other markets, notably the US, are looking to emulate.

The most fundamental change in Europe will be brought about by T2S, the pan-European settlement project initiated by the European Central Bank (ECB). Each of the 24 central securities depositories (CSDs) which have signed up will be obliged to outsource its settlement functions to a common platform, so that securities accounts across the corresponding markets are integrated onto a single securities settlement engine. All the main financial instruments will be eligible as part of the centralized pool: securities, eurobonds and investment funds held at the participating CSDs, whether issued inside or outside Europe.

After being mooted in 2006, the programme to build T2S was launched in 2007. T2S adopts the same concept as Target2 (T2) for cash movements. The ECB was able to look at how well the T2 platform operated, allowing the community to manage the whole of its cash across the Eurozone. Back then, markets were more buoyant than today, but the need to rationalize the European post-trade infrastructure remains as great as ever. "In European markets, settlement costs far outweighed those of the US – at multiples ranging from some two-and-a-half to five times – while volumes across Europe are typically just one-fifth to one-quarter of those in the US, for much the same population," comments Hugh Palmer, product manager responsible for T2S solutions at SGSS.

Asset managers and end-investors are sure to welcome a reduction in transaction costs, but T2S goes way beyond this. "By killing fragmentation, it will kill costs. The total expense of maintaining the current settlement platforms across the 24 CSDs is huge," Mr Palmer points out. Instead of having 24 settlement platforms to keep up-to-date, for which the costs are ultimately borne by end-investors, there will be just the one. Crucially, T2S will deliver greater efficiency and transparency and act as a catalyst to growth in cross-border investment and the development of capital markets across the region.

For the major players in Europe, particularly BNP Paribas and Societe Generale, integration of the infrastructure is sure to have a positive effect. "With markets being structured vertically, with heterogenous rules and procedures, it's a huge challenge for a global or regional custodian to put in place a single system and deliver consistently high levels of service across the board," Mr Palmer tells us.

To connect to T2S, an institution must be a participant of a CSD or a central bank and work through their intermediary – or be authorized by these parties to connect directly to T2S as a Directly Connected Participant (DCP). A DCP can communicate with T2S without using the relevant CSD or central bank as a relay or proxy for sending settlement instructions, receiving status advices, querying data and so forth directly to or from the platform.

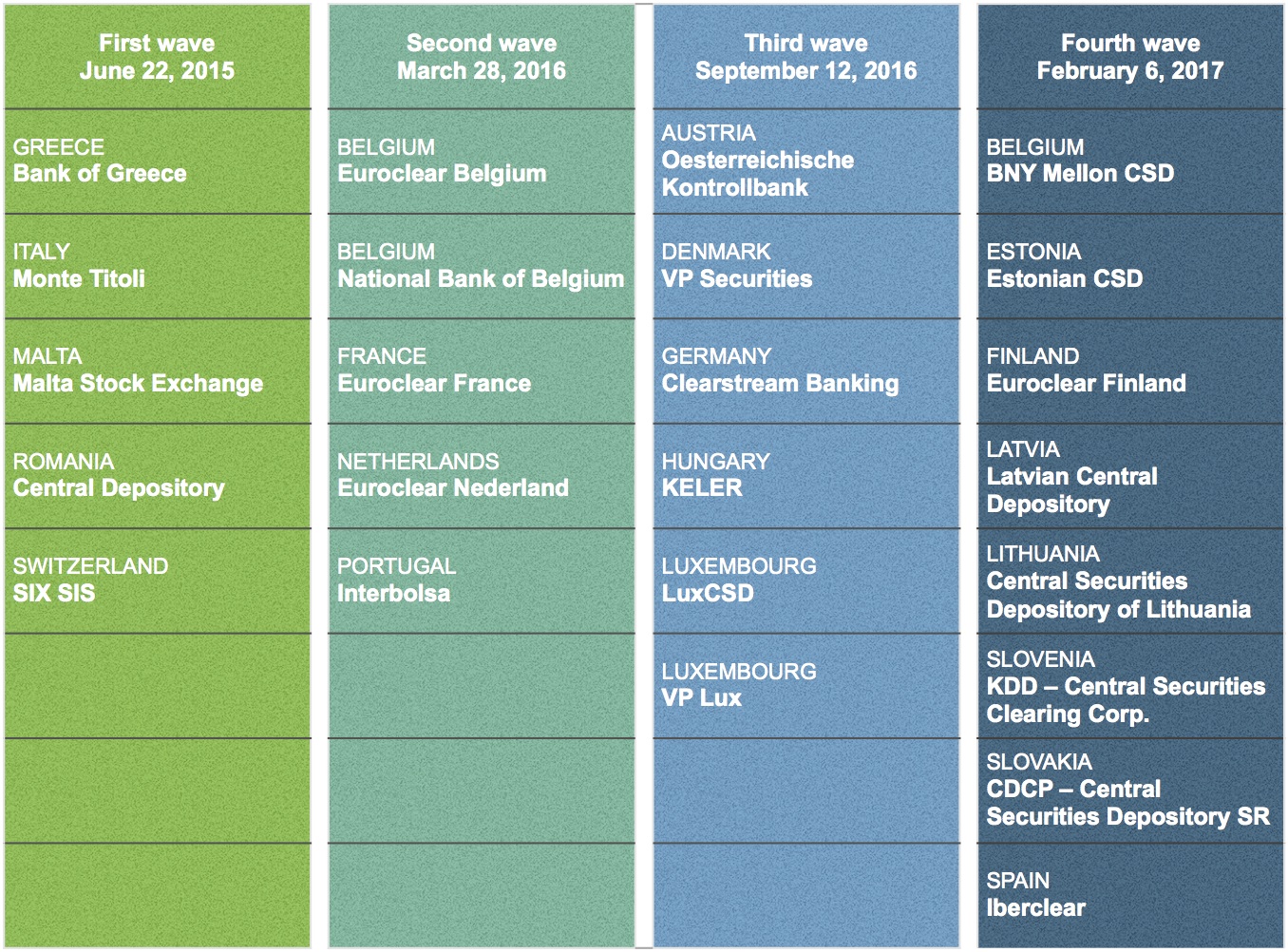

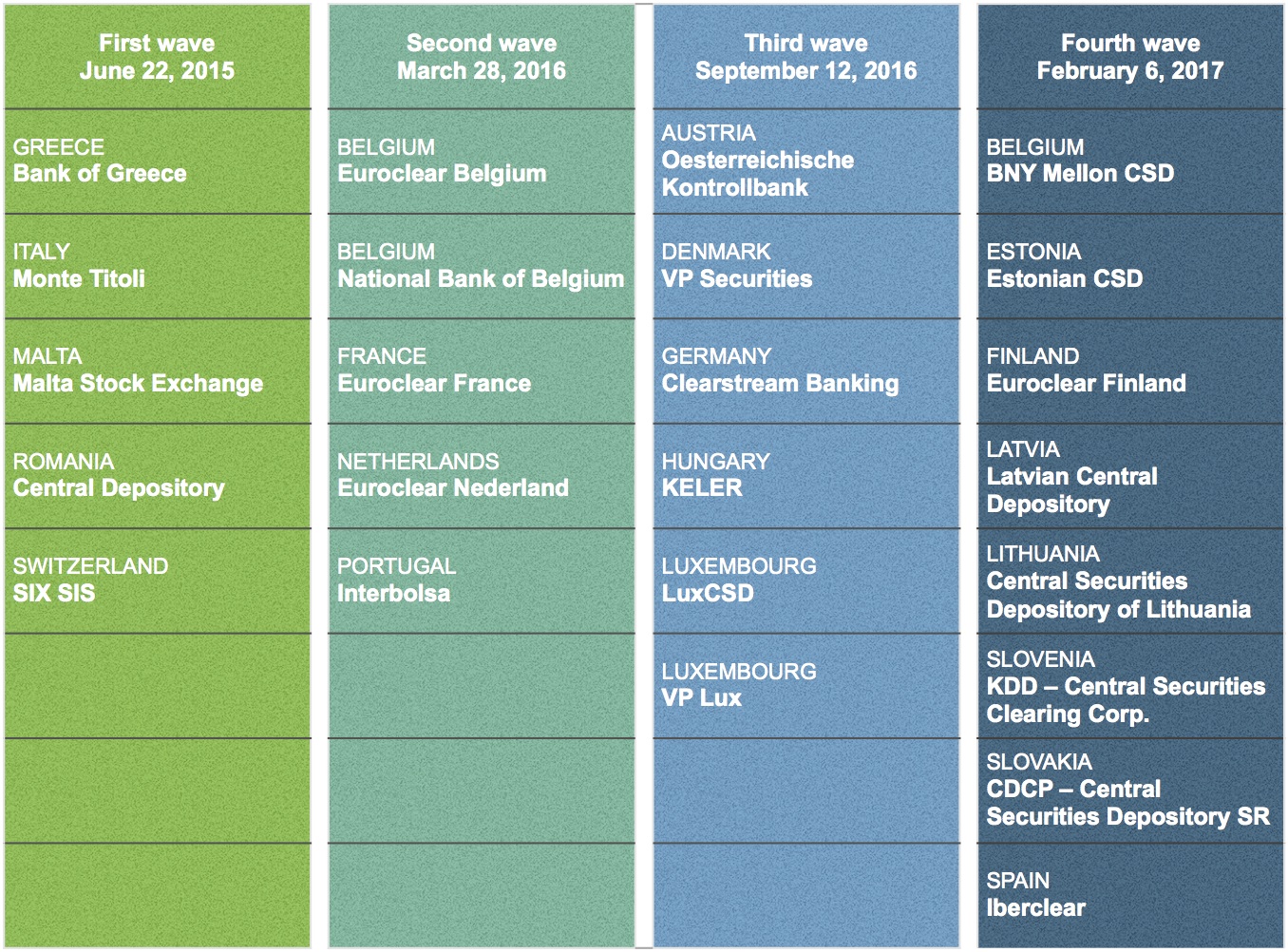

T2S | migration of CSDs in four waves

We are now on the brink of going live with the first group of migrating CSDs, but it's a little early to get excited yet. In terms of volumes, the only significant player in the first wave is Italy's Monte Titoli – so the June 2015 migration will bring little benefit in terms of integration and cross-border harmonization. It will largely be a chance for the various participants to test their links, to help them better prepare for the subsequent migration waves.

There are bound to be issues – in the T2S platform itself, at the CSD level and for the DCPs and their clients – and these will be much easier to resolve with just the handful of markets in the first wave. "At the outset, Societe Generale will have a direct link with Monte Titoli," Mr Palmer tells us, "and the first wave will be a chance to test our T2S development – in particular the activities for which we have direct linkage, as DCP, cutting out a local agent bank and the underlying CSD from the settlement chain when operating remotely, i.e. from outside of the wave 1 markets."

As more and more CSDs migrate to T2S during subsequent waves, investors, traders and broker-dealers – and their custodians and other intermediaries – should benefit from greater operational efficiencies. Market participants will be able to settle transactions through a single CSD, rather than at multiple venues, for trades in all participating markets. Because cash and securities will be consolidated on a common platform, cash can be conserved and operational risk and capital requirements reduced.

Liquidity management will be integrated, with securities and cash accounts centralized on the single platform. Securities accounts will be maintained on the respective CSD's books. A bank must open a Dedicated Cash Account (DCA) for T2S in the books of at least one of the respective national central banks. The cash leg of securities settlement will take place in the T2S DCA in euros (or another currency where supported by the central bank) in central bank money. The T2S DCAs will be funded from Target2 accounts and, additionally, through T2S auto-collateralization which will automatically mobilize eligible collateral for providing intraday credit on the DCA. The impact of T2S on liquidity will be profound, with it expected to account for half the liquidity exchanged in Target2.

T2S will standardize securities and cash settlement – serving to commoditize this core function. More so than ever, providers will differentiate themselves in asset servicing and other areas higher up the custody value chain.

Collateral management will be integrated, as the T2S platform creates a single collateral pool. Regulatory impositions and improved risk management practices are driving up the need for a higher quantity and quality of collateral assets to pledge against borrowings and derivatives trades. Finding the right type of collateral for each operation, and posting it to the relevant collateral taker, has become more challenging – and the present fragmented infrastructure across Europe means that collateral assets may not be in the right market at the right time. With movement of collateral across borders being complicated and costly, there is currently a need to maintain oversized buffers of collateral in each market to satisfy local needs. The single T2S platform will strip away the need for these buffers. Collateral will no longer be blocked in local markets – reducing the quantity of collateral assets required and easing the process of optimizing collateral usage.

How is the market moving?

While the full benefits of T2S will take some time to materialize, market participants are now paying it a good deal of attention. Typical requirements vary considerably from one institution to another, but a clear pattern is emerging according to the type of organization.

- Expect a seamless migration to T2S.

- Likely to delegate T2S facilities – such as hold and release, partial settlement and liquidity transfers – to their custodian.

- T2S is a key element in due diligence activities and Requests for Proposal.

- A move to 'local regional' network management.

- Likely to take a hands-on approach to T2S facilities such as hold and release, partial settlement and liquidity transfers.

- Top-tier banks: internalize settlement management, look for asset servicing only from agent banks.

- Mid-tier banks: piggy-back off a DCP.

- Smaller agent banks will exit the market.

- Private banks looking for high, consistent service levels.

Among broker-dealers, there has been a clear dichotomy. Many have been sitting on the sidelines – with settlement seen as non-core and, until this January, T2S not being placed on the agenda. By contrast, Mr Palmer points to a number of movers and shakers – not necessarily the larger players, more down to the culture of players within their institutions – who have been engaging for some time.

For private banks, "price is not the number one issue on their scorecard as they attach more importance to the security of their assets," says Mr Palmer. "Several pick best-in-class for a local custodian in each market and they are clearly expecting an outcome, in terms of service delivery, which is the same whether they are dealing with Frankfurt, Milan or Paris. The nature of their business is more asset-based than transaction-based, so quality of servicing is paramount."

Investment banks, and global custodians without their own European operations, are generally moving away from the traditional network structure of market-by-market relationships. They are typically rationalizing the number of relationships down to a regional approach, but in such a way that they do not lose out on the local engagement that they have in each of the markets. Some will have their own T2 account to manage their own liquidity, and will manage and pool their liquidity on their own DCA – looking to their custodian to manage the securities legs of transactions in T2S.

The top-tier investment banks and global custodians, with significant activities across Europe, see T2S as an opportunity to internalize their settlement management across the T2S zone. Today, this is simply not economically viable with the current fragmented settlement infrastructure across a multitude of CSDs. Looking forward to T2S, they are increasingly seeking out a 'local regional' custodian for more support in terms of asset servicing. Societe Generale has a track record here, having been providing unbundled asset servicing to "a very major European financial institution tor several years," Mr Palmer tells us. We understand this to be Euroclear under an outsourcing arrangement which encompasses Belgium, France and the Netherlands.

Mid-tier investment banks typically have a desire to become a DCP, but frequently do not have the business case for making the necessary investment. They are expected to turn to providers to piggy-back off their DCP pipework.

"Smaller players are asking themselves whether they should still be in the market," explains Mr Palmer. "Italy is a prime example, with some 600+ banks, many with membership of Monte Titoli. A number have decided to give up their membership – and all the associated costs – as this is no longer supported as a core part of their business."

Looking across buy- and sell-side, there is no one size that fits all. Each institution must examine what is core, and what is peripheral, in determining its priorities and its choice of T2S functionality. As ever, they should be able to rely on their service providers to work closely with them on this journey.

This site, like many others, uses small files called cookies to customize your experience. Cookies appear to be blocked on this browser. Please consider allowing cookies so that you can enjoy more content across fundservices.net.

How do I enable cookies in my browser?

Internet Explorer

1. Click the Tools button (or press ALT and T on the keyboard), and then click Internet Options.

2. Click the Privacy tab

3. Move the slider away from 'Block all cookies' to a setting you're comfortable with.

Firefox

1. At the top of the Firefox window, click on the Tools menu and select Options...

2. Select the Privacy panel.

3. Set Firefox will: to Use custom settings for history.

4. Make sure Accept cookies from sites is selected.

Safari Browser

1. Click Safari icon in Menu Bar

2. Click Preferences (gear icon)

3. Click Security icon

4. Accept cookies: select Radio button "only from sites I visit"

Chrome

1. Click the menu icon to the right of the address bar (looks like 3 lines)

2. Click Settings

3. Click the "Show advanced settings" tab at the bottom

4. Click the "Content settings..." button in the Privacy section

5. At the top under Cookies make sure it is set to "Allow local data to be set (recommended)"

Opera

1. Click the red O button in the upper left hand corner

2. Select Settings -> Preferences

3. Select the Advanced Tab

4. Select Cookies in the list on the left side

5. Set it to "Accept cookies" or "Accept cookies only from the sites I visit"

6. Click OK

Post-trade activities play a critical role. The safety and efficiency of the arrangements required to finalize securities transactions lie at the core of modern capital markets and are indispensable for their proper functioning. But clearing and settlement often operate in vertical silos, and are frequently too costly or complex, which serves to discourage trading and investment. A range of fixes are in play and, with Europe the principal focal point, we speak with Hugh Palmer of Societe Generale Securities Services (SGSS).

The key developments in Europe comprise a recent switch to T+2 settlement, along with enhancement of settlement discipline and asset safety under the European Union's 2014 Central Securities Depositories Regulation (CSDR). Soon to go live is Target2-Securities (T2S) which will integrate Europe's fragmented settlement and safekeeping infrastructure, and pool resources. These changes will create developed, reliable and effective capital markets in the region, through driving up efficiency and boosting cross-border investment.

Behind these initiatives is the Giovannini Group of financial-market participants, which was established in 1996 to advise the European Commission. In a 2001 report, the Group identified a total of 15 barriers to efficient cross-border clearing and settlement in the European Union. Together, CSDR and T2S contribute to the elimination of nine of the barriers.

In October 2014, a reduction in settlement timeframes to a standard T+2 cycle took effect in the vast majority of markets across the wider Europe. Initiated by the CSDR, this was achieved because of a huge effort on the part of central banks, regulators, market infrastructure bodies and custodian banks across 22 markets. The transition went smoothly, thanks to good planning by operations teams at asset managers and broker-dealers. In Europe, T+2 is now business as usual and seen as a great success which other markets, notably the US, are looking to emulate.

The most fundamental change in Europe will be brought about by T2S, the pan-European settlement project initiated by the European Central Bank (ECB). Each of the 24 central securities depositories (CSDs) which have signed up will be obliged to outsource its settlement functions to a common platform, so that securities accounts across the corresponding markets are integrated onto a single securities settlement engine. All the main financial instruments will be eligible as part of the centralized pool: securities, eurobonds and investment funds held at the participating CSDs, whether issued inside or outside Europe.

After being mooted in 2006, the programme to build T2S was launched in 2007. T2S adopts the same concept as Target2 (T2) for cash movements. The ECB was able to look at how well the T2 platform operated, allowing the community to manage the whole of its cash across the Eurozone. Back then, markets were more buoyant than today, but the need to rationalize the European post-trade infrastructure remains as great as ever. "In European markets, settlement costs far outweighed those of the US – at multiples ranging from some two-and-a-half to five times – while volumes across Europe are typically just one-fifth to one-quarter of those in the US, for much the same population," comments Hugh Palmer, product manager responsible for T2S solutions at SGSS.

Asset managers and end-investors are sure to welcome a reduction in transaction costs, but T2S goes way beyond this. "By killing fragmentation, it will kill costs. The total expense of maintaining the current settlement platforms across the 24 CSDs is huge," Mr Palmer points out. Instead of having 24 settlement platforms to keep up-to-date, for which the costs are ultimately borne by end-investors, there will be just the one. Crucially, T2S will deliver greater efficiency and transparency and act as a catalyst to growth in cross-border investment and the development of capital markets across the region.

For the major players in Europe, particularly BNP Paribas and Societe Generale, integration of the infrastructure is sure to have a positive effect. "With markets being structured vertically, with heterogenous rules and procedures, it's a huge challenge for a global or regional custodian to put in place a single system and deliver consistently high levels of service across the board," Mr Palmer tells us.

To connect to T2S, an institution must be a participant of a CSD or a central bank and work through their intermediary – or be authorized by these parties to connect directly to T2S as a Directly Connected Participant (DCP). A DCP can communicate with T2S without using the relevant CSD or central bank as a relay or proxy for sending settlement instructions, receiving status advices, querying data and so forth directly to or from the platform.

T2S | migration of CSDs in four waves

We are now on the brink of going live with the first group of migrating CSDs, but it's a little early to get excited yet. In terms of volumes, the only significant player in the first wave is Italy's Monte Titoli – so the June 2015 migration will bring little benefit in terms of integration and cross-border harmonization. It will largely be a chance for the various participants to test their links, to help them better prepare for the subsequent migration waves.

There are bound to be issues – in the T2S platform itself, at the CSD level and for the DCPs and their clients – and these will be much easier to resolve with just the handful of markets in the first wave. "At the outset, Societe Generale will have a direct link with Monte Titoli," Mr Palmer tells us, "and the first wave will be a chance to test our T2S development – in particular the activities for which we have direct linkage, as DCP, cutting out a local agent bank and the underlying CSD from the settlement chain when operating remotely, i.e. from outside of the wave 1 markets."

As more and more CSDs migrate to T2S during subsequent waves, investors, traders and broker-dealers – and their custodians and other intermediaries – should benefit from greater operational efficiencies. Market participants will be able to settle transactions through a single CSD, rather than at multiple venues, for trades in all participating markets. Because cash and securities will be consolidated on a common platform, cash can be conserved and operational risk and capital requirements reduced.

Liquidity management will be integrated, with securities and cash accounts centralized on the single platform. Securities accounts will be maintained on the respective CSD's books. A bank must open a Dedicated Cash Account (DCA) for T2S in the books of at least one of the respective national central banks. The cash leg of securities settlement will take place in the T2S DCA in euros (or another currency where supported by the central bank) in central bank money. The T2S DCAs will be funded from Target2 accounts and, additionally, through T2S auto-collateralization which will automatically mobilize eligible collateral for providing intraday credit on the DCA. The impact of T2S on liquidity will be profound, with it expected to account for half the liquidity exchanged in Target2.

T2S will standardize securities and cash settlement – serving to commoditize this core function. More so than ever, providers will differentiate themselves in asset servicing and other areas higher up the custody value chain.

Collateral management will be integrated, as the T2S platform creates a single collateral pool. Regulatory impositions and improved risk management practices are driving up the need for a higher quantity and quality of collateral assets to pledge against borrowings and derivatives trades. Finding the right type of collateral for each operation, and posting it to the relevant collateral taker, has become more challenging – and the present fragmented infrastructure across Europe means that collateral assets may not be in the right market at the right time. With movement of collateral across borders being complicated and costly, there is currently a need to maintain oversized buffers of collateral in each market to satisfy local needs. The single T2S platform will strip away the need for these buffers. Collateral will no longer be blocked in local markets – reducing the quantity of collateral assets required and easing the process of optimizing collateral usage.

How is the market moving?

While the full benefits of T2S will take some time to materialize, market participants are now paying it a good deal of attention. Typical requirements vary considerably from one institution to another, but a clear pattern is emerging according to the type of organization.

- Expect a seamless migration to T2S.

- Likely to delegate T2S facilities – such as hold and release, partial settlement and liquidity transfers – to their custodian.

- T2S is a key element in due diligence activities and Requests for Proposal.

- A move to 'local regional' network management.

- Likely to take a hands-on approach to T2S facilities such as hold and release, partial settlement and liquidity transfers.

- Top-tier banks: internalize settlement management, look for asset servicing only from agent banks.

- Mid-tier banks: piggy-back off a DCP.

- Smaller agent banks will exit the market.

- Private banks looking for high, consistent service levels.

Among broker-dealers, there has been a clear dichotomy. Many have been sitting on the sidelines – with settlement seen as non-core and, until this January, T2S not being placed on the agenda. By contrast, Mr Palmer points to a number of movers and shakers – not necessarily the larger players, more down to the culture of players within their institutions – who have been engaging for some time.

For private banks, "price is not the number one issue on their scorecard as they attach more importance to the security of their assets," says Mr Palmer. "Several pick best-in-class for a local custodian in each market and they are clearly expecting an outcome, in terms of service delivery, which is the same whether they are dealing with Frankfurt, Milan or Paris. The nature of their business is more asset-based than transaction-based, so quality of servicing is paramount."

Investment banks, and global custodians without their own European operations, are generally moving away from the traditional network structure of market-by-market relationships. They are typically rationalizing the number of relationships down to a regional approach, but in such a way that they do not lose out on the local engagement that they have in each of the markets. Some will have their own T2 account to manage their own liquidity, and will manage and pool their liquidity on their own DCA – looking to their custodian to manage the securities legs of transactions in T2S.

The top-tier investment banks and global custodians, with significant activities across Europe, see T2S as an opportunity to internalize their settlement management across the T2S zone. Today, this is simply not economically viable with the current fragmented settlement infrastructure across a multitude of CSDs. Looking forward to T2S, they are increasingly seeking out a 'local regional' custodian for more support in terms of asset servicing. Societe Generale has a track record here, having been providing unbundled asset servicing to "a very major European financial institution tor several years," Mr Palmer tells us. We understand this to be Euroclear under an outsourcing arrangement which encompasses Belgium, France and the Netherlands.

Mid-tier investment banks typically have a desire to become a DCP, but frequently do not have the business case for making the necessary investment. They are expected to turn to providers to piggy-back off their DCP pipework.

"Smaller players are asking themselves whether they should still be in the market," explains Mr Palmer. "Italy is a prime example, with some 600+ banks, many with membership of Monte Titoli. A number have decided to give up their membership – and all the associated costs – as this is no longer supported as a core part of their business."

Looking across buy- and sell-side, there is no one size that fits all. Each institution must examine what is core, and what is peripheral, in determining its priorities and its choice of T2S functionality. As ever, they should be able to rely on their service providers to work closely with them on this journey.